steamboat springs colorado sales tax rate

What is the sales tax rate in Steamboat Springs Colorado. View details map and photos of this single family property with 2 bedrooms and 2 total baths.

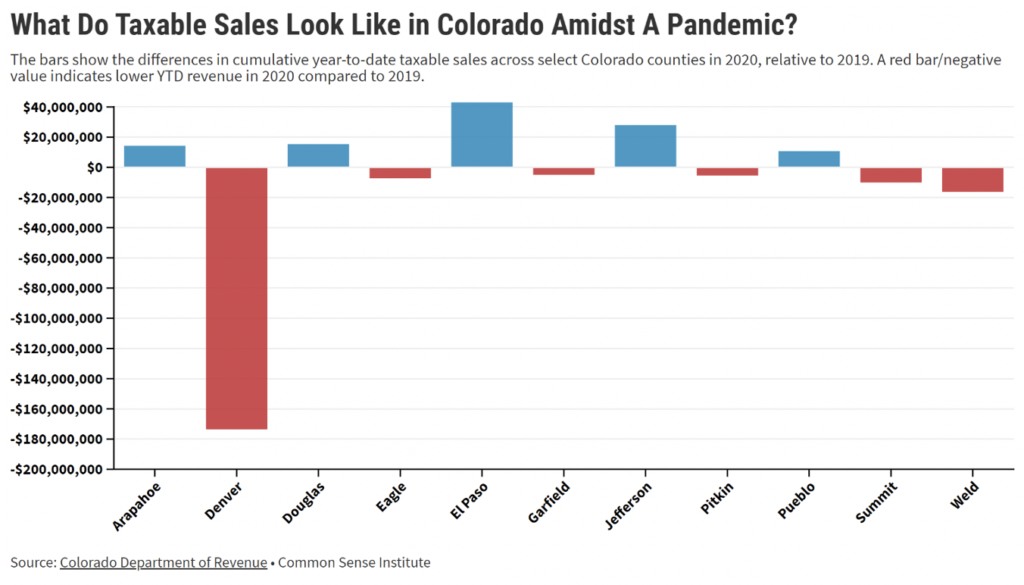

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

View more property details sales history and Zestimate data on Zillow.

. Within Steamboat Springs there are around 2 zip codes with the most populous zip code being 80487. Did South Dakota v. City Sales Tax.

The latest sales tax rates for cities starting with S in Colorado CO state. Method to calculate Steamboat Springs sales tax in 2021. The latest sales tax rate for Steamboat Springs CO.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Tax Jurisdiction Tax Rate State of Colorado 29 Routt County 10 City of Steamboat Springs 45 Total combined sales tax rate inside the City 84 Documentation provided outside City no permits or certificates 84 39 County building permits 74 29 City building permits 29 29 sales tax licenses 00 00 exemption certificates 00 00. The Steamboat Springs Colorado sales tax rate of 84 applies to the following two zip codes.

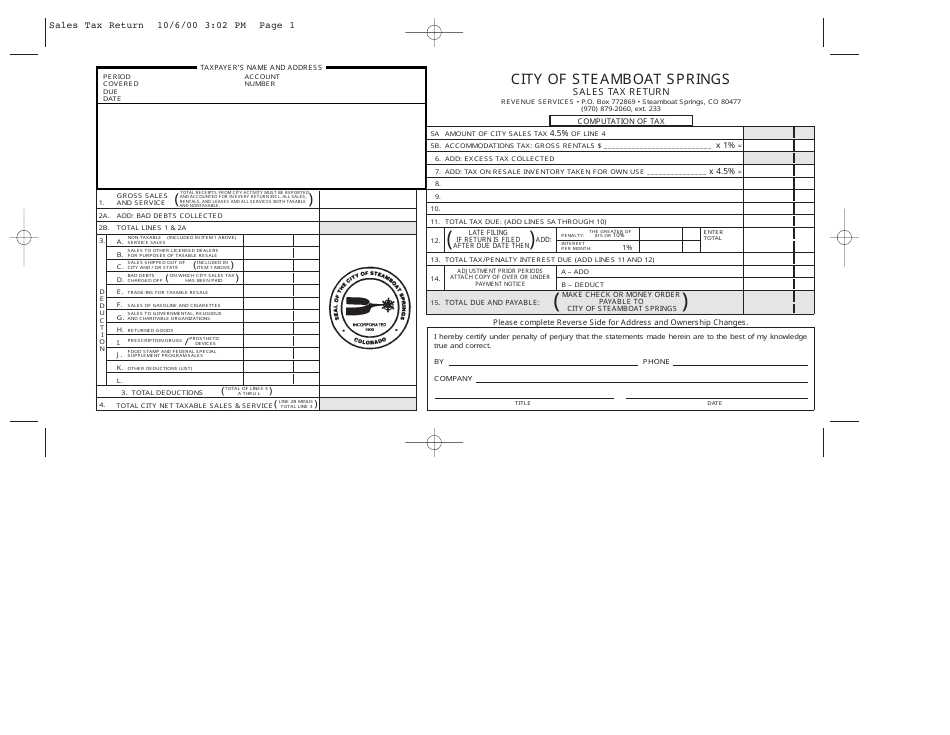

Live in Routt County. On November 3 2015 Colorado Springs voters approved a sales and use tax rate increase of 062 to fund road repair maintenance and improvements. The Steamboat Springs sales tax rate is 45 Steamboat Springs accommo-dations tax rate is 1 of the retail purchase price.

The combined amount is 820 broken out as follows. 2020 rates included for use while preparing your income tax deduction. In general there are three aspects to real property taxation namely.

An alternative sales tax rate of 84 applies in the tax region Steamboat Springs Local Marketing District which appertains to zip code 80488. Legal Address Tax Percentage. For Sale - 435 Willow Ct Steamboat Springs CO - 1450000.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Buyer and seller both in Hayden. Rates include state county and city taxes.

The current total local sales tax rate in Colorado Springs CO is 8200. Steamboat Springs is located within Routt County Colorado. The average cumulative sales tax rate in Steamboat Springs Colorado is 84.

Live in Steamboat Springs. Steamboat Springs sales tax is levied on tangible personal property and taxable services that are purchased sold leased or rented within the City of Steamboat Springs. Creating tax rates estimating market value and then collecting the tax.

This rate includes any state county city and local sales taxes. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Ness license and the State of Colorado sales tax license.

The minimum combined 2022 sales tax rate for Steamboat Springs Colorado is. Tax Rates City Sales Tax 40 School Tax 05 City of Steamboat Springs REMIT TO CITY 45 City Accommodations REMIT TO CITY 10 State of Colorado REMIT TO STATE 29 Routt County REMIT TO STATE 10 Total Combined Tax Rate 94 LMD Accommodations Tax REMIT TO STATE 20. The Steamboat Springs sales tax rate is.

The sales tax rate does. The average sales tax rate in Colorado is 6078. Steamboat Springs in Colorado has a tax rate of 84 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Steamboat Springs totaling 55.

The City of Steamboat Springs is a home rule municipality with its own Municipal Code collecting its own sales tax. You can find more tax rates and allowances for Steamboat Springs and. Page 1 of 12 DR 1002 010122 COLORADO DEPARTMENT OF REVENUE Taxpayer Service Division PO Box 17087 Denver CO 80217-0087 Colorado SalesUse Tax Rates For most recent version see TaxColoradogov This publication which is updated on January 1 and July 1 each year lists Colorado SalesUse Tax rates throughout the.

2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. This is the total of state county and city sales tax rates. This includes the sales tax rates on the state county city and special levels.

The Colorado sales tax rate is currently. Colorado CO Sales Tax Rates by City S The state sales tax rate in Colorado is 2900. In order to legally conduct sales within Steamboat Springs.

Sales Tax State Local Sales Tax on Food. Home is a 2 bed 20 bath property. The current tax rates are as follows.

Buyer and seller both in Oak Creek. The Steamboat Springs Sales Tax is collected by the merchant on all qualifying sales made within Steamboat Springs. View Property Details for 1945 Cornice Steamboat Springs CO at REcolorado.

Groceries are exempt from. Sales Use Tax Sales tax is due at the time of titling. The Steamboat Springs Colorado sales tax is 840 consisting of 290 Colorado state sales tax and 550 Steamboat Springs local sales taxesThe local sales tax consists of a 100 county sales tax and a 450 city sales tax.

The December 2020 total local sales tax rate was 8250. Under Colorado law the government of Steamboat Springs public hospitals and thousands of various special purpose units are given authority to estimate real estate market value determine tax rates. Motor Vehicle Title Registration Resources.

2020 rates included for use while preparing your income tax deduction. The County sales tax rate is. With local taxes the total sales tax rate is between 2.

40571 Steamboat Dr Steamboat Springs CO 80487-9568 is a single-family home listed for-sale at 790000. Real property tax on median home.

Craig S 2022 Sales Taxes Up Through First Three Months Of The Year Craigdailypress Com

Economy In Steamboat Springs Colorado

City Of Steamboat Springs Colorado Sales Tax Return Form Download Printable Pdf Templateroller

Steamboat Springs Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

January Lodging Tax Numbers Up As Steamboat Springs Enjoys Strong 2021 22 Ski Season Steamboattoday Com

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

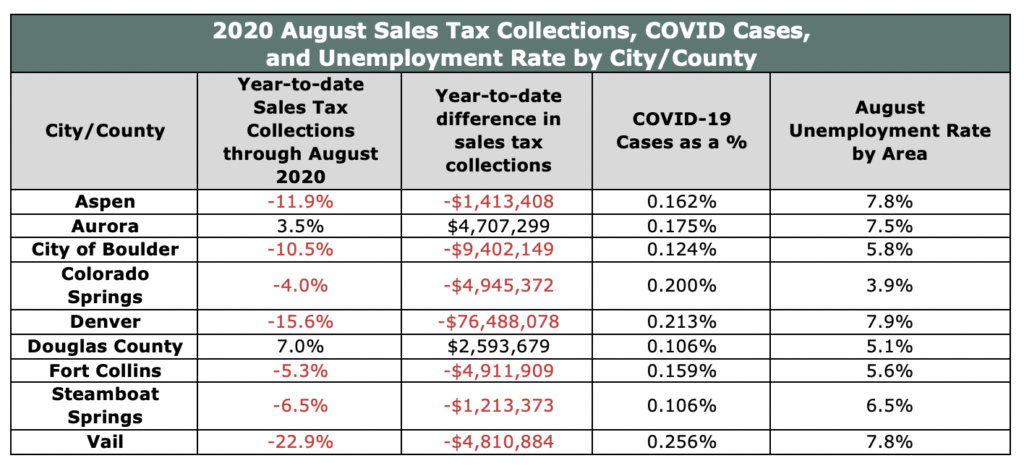

As Sales Tax Revenue Continues Decline City Of Steamboat Faces Tough Choices For 2021 Budget Steamboattoday Com

Steamboat Springs Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

As Sales Tax Revenue Continues Decline City Of Steamboat Faces Tough Choices For 2021 Budget Steamboattoday Com

Surging Sales Tax Revenues Continue To Puzzle Budget Managers Steamboattoday Com

News Flash Steamboat Springs Co Civicengage

Is A 20 Tax On Strs Too Much Not For Crested Butte And Ouray Steamboattoday Com

Colorado Sales Tax Rates By City County 2022

Growth Of Summit County State Marijuana Sales Levels Off In 2018 Summitdaily Com

News Flash Steamboat Springs Co Civicengage

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Colorado Sales Tax Calculator And Economy 2022 Investomatica